4. Financial Planning and Forecasting

This is where Budget Vision's magic happens. With your accounts and recurring transactions set up, you can now use the calendar to make informed financial decisions.

Spotting Risky Periods

Look at your calendar. The Daily Balance for each day shows your projected cash flow. You can easily spot moments of risk.

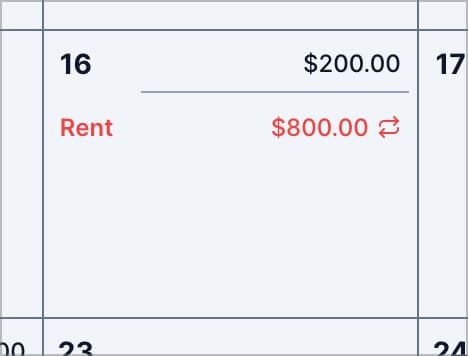

Here we can see that after the rent payment, the balance will be just $200. This is a risky period until the next paycheck.

Here we can see that after the rent payment, the balance will be just $200. This is a risky period until the next paycheck.

Analyzing Your Spending Power

Your daily balances show you how much you can truly afford to spend.

This view tells us we have a buffer of $200 for any unexpected expenses before the 19th. If a friend asks to go out, we know that waiting until after the 19th would be a much safer financial choice.

This view tells us we have a buffer of $200 for any unexpected expenses before the 19th. If a friend asks to go out, we know that waiting until after the 19th would be a much safer financial choice.

Modeling Scenarios

What if an unexpected expense appears? Just add it to the calendar and see the impact instantly.

After adding a forgotten yearly subscription, we can see that our buffer is gone. It's a good thing we could see this in advance!

After adding a forgotten yearly subscription, we can see that our buffer is gone. It's a good thing we could see this in advance!

Use the calendar as a playground. Drag transactions around to find the best time to spend and save. This is the core of proactive financial planning. See our guide on "What-If" Scenario Planning for more.